The Philippine stock market has been underperforming against its regional peers as of mid-December as the local bourse has been seeing weak trading volumes while foreign funds continued to leave.

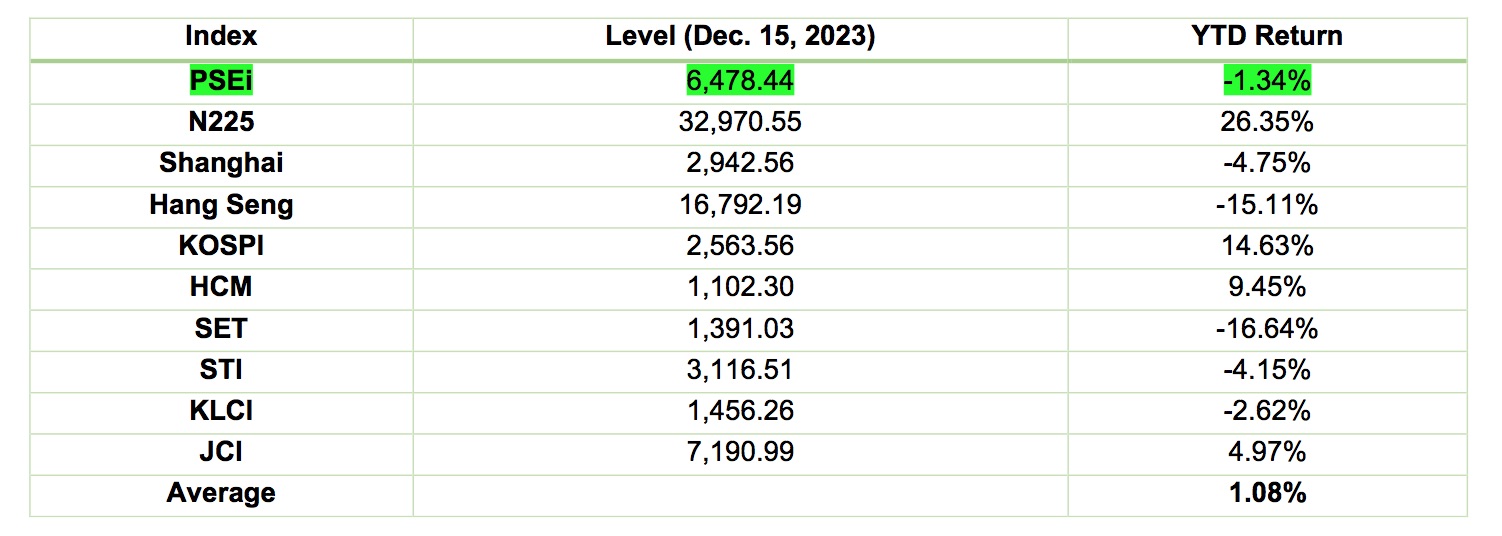

According to Philstocks Financial Research Manager Japhet Tantiangco, “as of December 15, 2023, the local market is at 6,478.44, up by 4.09 percent month-to-date, but down by 1.34 percent year-to-date.”

“For 2023 so far, the local market’s value turnover, net of block sales, has been averaging P4.89 billion per day, lower than 2022’s daily average of P5.92 billion,” he added.

Meanwhile, Tantiangco said net foreign transactions for this year, so far, have posted a net outflow of P48.7 billion, narrower compared to 2022’s P65.95 billion net selling.

“Of the market indices that we have been watching in the Southeast and East Asian region, the Philippine stock market is one of the underperformers so far as its -1.34 percent year-to-date return is below the group’s average of 1.08 percent,” he noted.

The local market experienced rallies by the start of 2023 and nearing the end of the year.

The Philippine Stock Exchange Index (PSEi) started the year on a positive note, rising 8.7 percent from end-2022 to its high for the year of 7,137.62 touched in January 24, 2023.

This came as the US’ inflation declined from November 2022’s 7.1 percent to December 2022’s 6.5 percent, raising hopes back then that the US Federal Reserve will pause with its monetary tightening.

From its lowest close for the year of 5,961.99 touched last Oct. 27, 2023, the local market moved upwards towards the end 2023.

This was driven by the decline of inflation in the Philippines in October and November, the satisfactory third quarter gross domestic product (GDP) growth, the decline in the US’ long term treasury yields, and the Federal Reserve’s hints of three 25 basis point cuts in their policy rates by 2024.

“For the most part of the year however, the local market has been heavily challenged, evidenced by its decline from its January peak to its October low,” said Tantiangco.

He noted that, “adding to this is the poor confidence of investors to get into the market amid the uncertainties as shown by our anemic value turnover for the year.”

Factors that weighed on the local stock market this year include the slowdown in economic growth to 5.6 percent in the first nine months of 2023 compared to 7.8 percent in the same period last year. This includes a 4.3 percent growth in the second quarter of 2023, the lowest since the 3.8 percent in the first quarter of 2021.

Meanwhile, inflation rate accelerated to 6.2 percent in the first 11 months of the year from 5.6 percent in the same period last year. This is also above the government’s two percent to four percent target.

Also, the Bangko Sentral ng Pilipinas raised its policy rate from 5.5 percent in end-2022 to a record of 6.5 percent by Dec. 14.

Offshore headwinds include the following: further tightening and hawkish messages from the Federal Reserve; banking sector worries triggered by the collapse of the Silicon Valley Bank and the failure of Credit Suisse; Budget Impasse in the US’ congress; weakening of China’s economy; and the Israel-Hamas Conflict.